Form 1065 tax free#

The relief will only be available for the 2020 tax return and only if the partnership adheres to the new instructions.įor more information about this article, please contact our tax professionals at toll free at 844.4WINDES (844.494.6337). The agencies plan to issue a notice regarding this, stating that there will be no penalty assessed for tax year 2020 if there is an error on the partners’ tax basis capital accounts reporting on Schedule K-1. This will cover the transition period for the 2020 tax year.

This tax basis method requires partnerships to report several elements, including: Partnerships must use this tax basis method to calculate their partner capital accounts. The altered instructions require partnerships to use the transaction approach when filing this form for the 2020 tax year. The goal of the change is to facilitate greater compliance. The instructions aim to improve the quality of the information that the partnerships report to both the IRS and their partners.

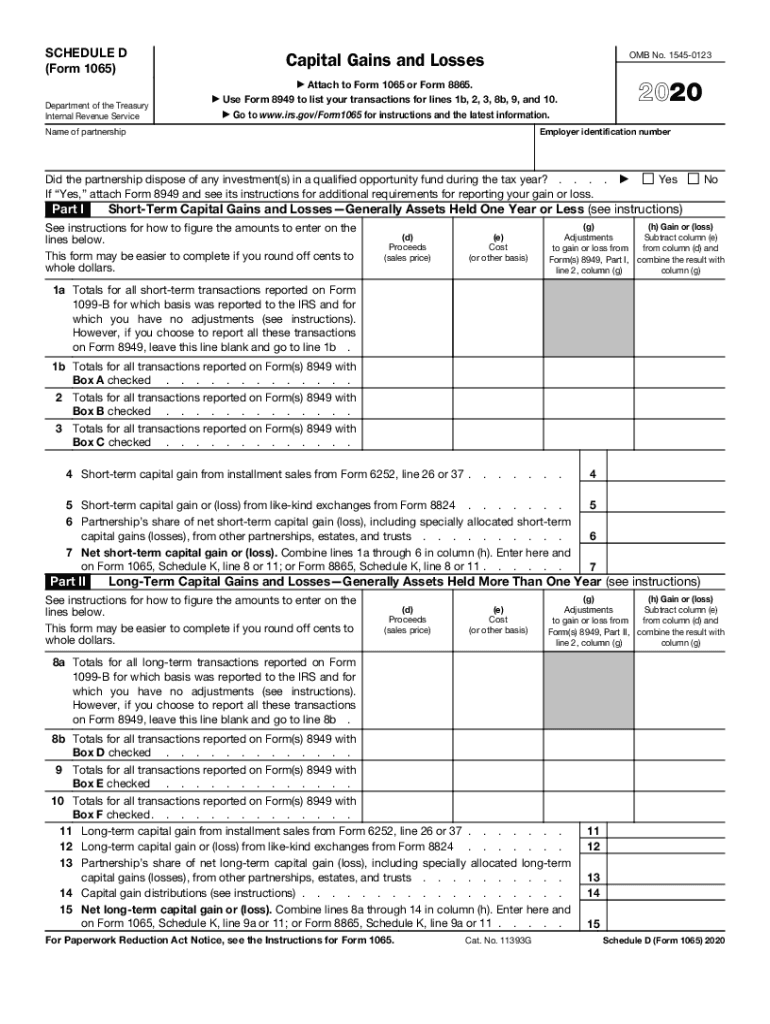

The IRS has released these revised instructions as part of a more widespread agency effort to improve compliance. These revised instructions require partnerships to report partners’ tax basis capital account balances on Schedule K-1.įacilitating Increased Compliance by Improving Information Quality They apply to the 2020 tax year (or 2021 filing season). As a result, all partnerships must report business interest expense to partners on Schedules K-1 (Form 1065). What is the penalty for filing a Form 1065 late? The penalty is $210 for each month or part of a month (for a maximum of 12 months) the failure continues, multiplied by the total number of persons who were partners in the partnership during any part of the partnership’s tax year for which the return is due.The IRS has released an early draft of instructions for 2020 Form 1065, U.S. effective for tax years beginning after November 12, 2020. File Form 1065 and Copies of the K-1 Forms.Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. If you are a partner in a partnership, the information you need to prepare your individual tax return is on the Schedule K-1 you received from the partnership, not on Form 1065. You can file Form 1065 using TurboTax Business. Partnerships must also submit a completed Schedule K-1. This form is filed by LLCs, foreign partnerships with income in the U.S., and nonprofit religious organizations.

IRS Form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. Amounts entered will then pull to the appropriate form, schedule or line of the taxpayer’s 1040. Schedule K-1 (Form 1065) is a source document that is prepared by a Partnership as part of the filing of their tax return (Form 1065). Income, credits, and deductions are passed through to their partners to be reported and taxed on their own personal tax returns.

Form 1065 doesn’t calculate any tax that’s due because partnerships don’t pay their own taxes. You might be interested: What Is The Capital Gains Tax Rate In Michigan? (TOP 5 Tips) Do I file 1065 with my 1040? IRS Form 1065 is an information return that reports partnership income to the IRS.

0 kommentar(er)

0 kommentar(er)